The Covid-19 pandemic disrupted national and global economies and food systems, prompting a discussion of efficiency versus resilience in supply chains, including the food supply chain. In the US, the food supply system experienced a demand shock as consumers stocked up on food and staples in March 2020 and a supply shock when meatpacking plants closed in April and May 2020 as workers contracted the virus.

These consumer demand and meat supply shocks were augmented by a third shock, the decrease in food purchases by restaurants and food service firms that buy farm commodities to serve consumers away from home. Almost 40 percent of food spending is for food eaten away from home. The closure of many restaurants to prevent the spread of Covid-19 reduced demand for items destined for away-from-home consumption, including small packages of milk for children in schools and cuts of meat favored by restaurants.

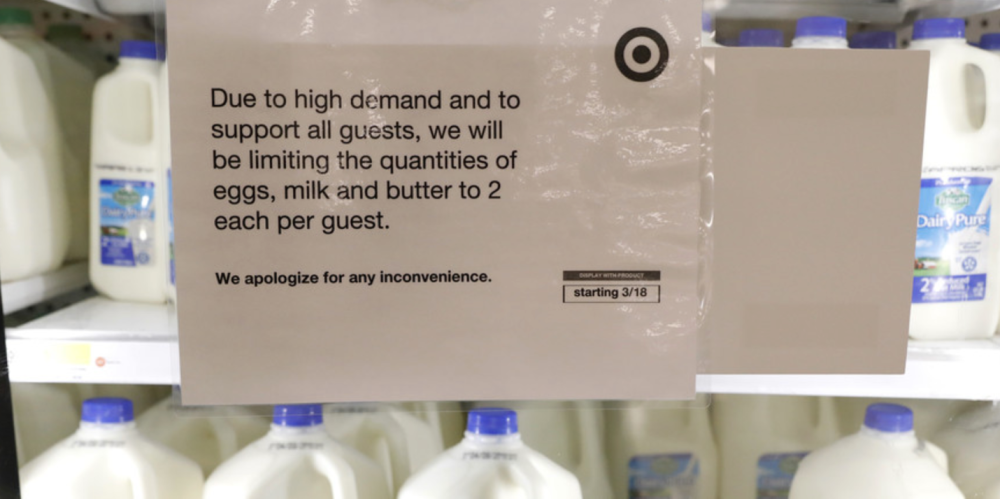

The sudden decrease in the demand for food from restaurants and other food service outlets and stockpiling by consumers led to simultaneous surpluses and shortages. Some farmers dumped milk that they could not sell, while some stores limited how much milk consumers could buy.

The efficiencies achieved by specialization in food production proved to less resilient when demand changed suddenly. Milk processing plants could not quickly change from packaging pints of milk to gallons, or processing fresh milk into cheese, resulting in dumped milk. Farmers who specialized in growing commodities for food service firms, such as Idaho potato growers, lost more sales than growers who specialized in providing commodities to consumers via supermarkets.

Before Covid-19, food preparation was moving from homes to food processors and food service firms, as exemplified by chicken breasts and legs rather than whole chickens and bagged salads rather than heads of lettuce. The cost of labor in food processing and food service is lower than the average wage of consumers, and rising education levels as well as more women working for wages expanded the demand for convenient food that requires less time to prepare.

Consumer behavior is likely to change as a result of Covid-19, as consumers shift more buying online rather than visiting supermarkets and perhaps purchasing more takeout meals and reducing in-restaurant dining. However, there is unlikely to be a retreat from consumer-ready food items such as cut-up meat and bagged salads.

Covid-19 is expected to speed automation in the food supply chain. Farmers have an aging and half unauthorized farm workforce that costs at least $15 an hour in wages and payroll taxes. The alternative of H-2A guest workers that cost $20 an hour or more is likely to speed the search for labor-saving management changes and mechanization, and may increase imports of labor-intensive commodities from lower-wage countries.

Food processors are likely to automate as well. Most food processing is done in cold workrooms with workers in close proximity, ideal conditions for spreading viruses. Meatpacking plants with thousands of employees, and food processing plants with hundreds, are expected to speed up efforts to replace workers with machines.

The Covid-19 pandemic is not over, and its effects are not yet clear. However, more mechanization is expected on farms, in food processing plants, and in food service. Mechanization that in the past was driven by the quest to reduce labor costs is also motivated by a desire to increase resilience in the event of pandemic disruptions.

Dumping Milk and Limits on Milk Purchases, March-April 2020

Workers are often close together in cold food processing plants, allowing Covid-19 to persist and spread

Georgia Tech developed a robot to debone chicken

Author

Mexico Institute

The Mexico Institute seeks to improve understanding, communication, and cooperation between Mexico and the United States by promoting original research, encouraging public discussion, and proposing policy options for enhancing the bilateral relationship. A binational Advisory Board, chaired by Luis Téllez and Earl Anthony Wayne, oversees the work of the Mexico Institute. Read more

Explore More

Browse Insights & Analysis

Russia’s Security Approach to Public Health

WIPO is AWOL