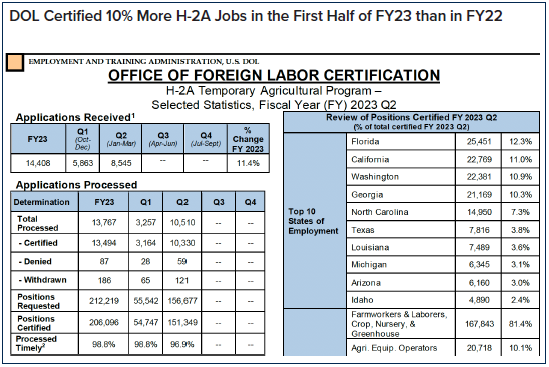

The H-2A program expanded in FY23. DOL certified 13,500 applications to fill 212,000 jobs with H-2A workers in the first two quarters of FY23, up from 12,000 applications to fill 193,000 jobs with H-2A workers in the first half of FY22, up 10 percent. H-2A job certifications may surpass peak mid-1950s Bracero admissions of 455,000 before 2025.

DOL certified 372,000 jobs to be filled with H-2A workers in FY22, including 14 percent in the first quarter, 39 percent in quarter two, 27 percent in quarter three, and 21 percent in quarter four. Over half of H-2A certifications are in five states. During the first half of FY23, 14 percent of H-2A certifications were in Florida, 12 percent were in California, nine percent each were in Georgia and Washington, and seven percent were in North Carolina.

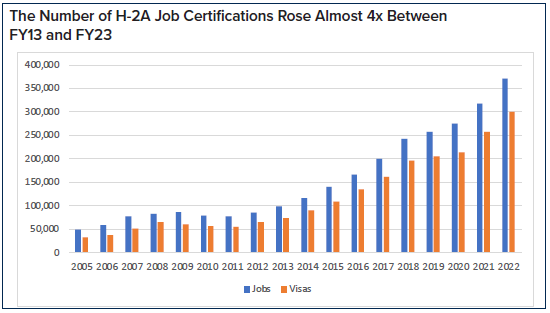

H-2A visas are issued to workers for about 80 percent of H-2A jobs certified; some employers do not follow through and employ H-2A workers, and some H-2A workers are able to fill two more or more H-2A jobs. In FY22, some 276,000 H-2A visas or 93 percent went to Mexicans, 9,500 or three percent to South Africans, and 4,900 or two percent to Jamaicans.

Analysis of FY22 H-2A job certification data highlight three major features of the H-2A program:

1. About 12,200 US farm employers hire H-2A workers, which is less than two percent of the 110,000 farms registered with state UI systems and the 500,000+ farms that report labor expenses to the COA. H-2A employers include 1,100 FLCs who often take H-2A workers to multiple farms, so H-2A workers could be employed on 20,000 to 30,000 farms sometime during the year.

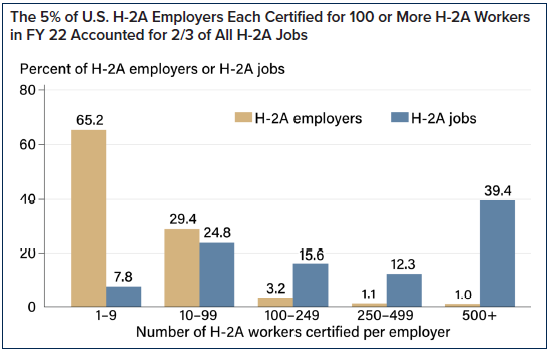

2. H-2A job certifications are concentrated among relatively few large employers. The 100 largest H-2A employers account for 40 percent of all H-2A job certifications, and the 600 largest account for 70 percent. Seven of the 10 largest H-2A employers are FLCs.

3. Most large H-2A employers have in-house compliance units and achieve economies of scale in recruiting, housing, and deploying H-2A workers. Enrolling them in a TSA-style trusted employer program and permitting them to self-certify their need for H-2A workers and housing could free up resources to deal with the 11,000+ smaller H-2A employers who may not understand or comply with H-2A regulations.

Growth

Why did the H-2A program remain below 100,000 jobs until after the 2008-09 recession, and then quadruple between FY13 and FY23? There are several answers, including the path dependence associated with farm employers and associations that had experience with the H-2A program before the recession who expanded when unauthorized Mexico-US migration slowed in the recovery. Arizona and many southeastern states enacted laws in the early 2010s that required employers to use E-Verify to check new hires and to discourage unauthorized foreigners from remaining in the state. Net farm income was higher-than-average between 2011 and 2013, which may have encouraged some farmers to invest in housing for H-2A workers.

80-20

Farming is an 80-20 or 90-10 industry, meaning that 80 to 90 percent of farms are small and account for 10 to 20 percent of total production and employment, while the largest 10 to 20 percent of farms account for 80 to 90 percent of total production and employment. Since most farms are small and produce a small share of total farm output, and a relatively few large farms account for most farm output, averages based on all farms can be misleading.

Some 110,000 farm employers are registered with state UI authorities, and over 513,000 farms reported labor expenses for directly hired workers in the 2017 COA. However, the largest five percent of these farm employers account for half to three-fourths of total farm employment. The 10 percent of UI-covered farm establishments with 10 or more employees in the second quarter of 2022 accounted for 80 percent of total UI-covered agricultural employment, while the seven percent of farms that each hired 10 or more workers directly in the COA accounted for 52 percent of all directly hired workers in 2017.

Employment in particular commodities and among the crop support service firms that bring workers to farms is even more concentrated. The 10 largest lettuce firms account for over half of total production, although it is hard to measure each firm’s exact share of production and employment because of ever-changing farming partnerships and extensive reliance on FLCs and other nonfarm businesses to bring workers to farms (there are no government data on the commodities of workers employed by crop support service firms). Similarly, there are about 3,000 US FLCs registered with state UI systems, but the largest 10 percent, about 300, likely account for over 80 percent of FLC employment.

Size structure is easier to measure for the H-2A program because employers specify how many H-2A workers they want. Employer applications do not record the number of US workers who are employed alongside H-2A workers, but most FLCs with H-2A workers have workforces that are almost exclusively H-2A workers.

Policy

What does an 80-20 farm employment structure mean for labor market regulation? DOL’s Wage and Hour Division, which enforces employer compliance with H-2A regulations, investigates about 1,000 US farms a year, finds violations on 70 percent of the farms that are investigated, and determines that three-fourths of the back wages owed and three-fourths of the civil money penalties assessed are for violations of H-2A regulations.

As the H-2A program continues to expand, what could be done to improve farm employer compliance with labor laws? One option would be to segment H-2A employers and treat those who are most likely to be in compliance with H-2A regulations differently. Given the 80-20 nature of H-2A employers and employment, if the largest employers with a record of compliance were exempted from some regulatory steps, DOL would have more resources to deal with H-2A employers whose business models are based on exploiting vulnerable workers.

There are many examples of H-2A employers whose violations are not detected until something goes very wrong. An immigrant crew supervisor on a large farm may become a FLC who recruits US workers from the crews he supervises and recruits H-2A workers from his hometown abroad to serve more farms, not understanding or obeying H-2A requirements to provide adequate housing or having the capital needed to continue to pay wages even when farm clients do not pay on time. The FLC may not pay employees for all of the hours they worked or not pay wages promptly, and H-2A migrants may not complain until there is an accident or paychecks bounce. When the violations are exposed, it becomes apparent that the FLC’s business model depended on everything going just right, which rarely happens in agriculture.

There are also large employers who abuse and exploit H-2A and US workers. Operation Blooming Onion in South Georgia in 2022 alleged that 28 people affiliated with the Gomez FLC business charged thousands of H-2A workers for their jobs, placed them in substandard housing, and paid them low wages. The farms where the H-2A workers were employed said they did not know about the worker abuse, which may have been facilitated by Gomez relatives who were Georgia state officials responsible for monitoring farm worker welfare.

A manager at Blaine Larsen Farms in Dalhart Texas required 500 H-2A workers to each pay up to $1,500 for their jobs, a scheme that went undetected until several workers died of covid in summer 2020. Blaine Larsen paid $1.3 million in back wages in 2022 because Larson did not pay overtime wages to warehouse workers who packed both Larson’s potatoes and potatoes from other farms, making them nonfarm workers entitled to overtime wages. Larson replaced its Texas managers, hired an HR manager to ensure compliance, and underwent several SEDEX Ethical Trade Audits.

The major H-2A enforcement issue is that employers make 20+ promises or attestations on their certification forms that they are expected to fulfill. US workers who are dis-satisfied with their employers can quit, but H-2A workers who are fired lose their right to be in the US. Labor law enforcement depends on worker complaints, and vulnerable workers rarely complain, which is why a tragedy is often required to prompt a complaint and investigation that discovers labor law violations.

Could membership in an association or private certification separate good or compliant H-2A employers from others? After the 9/11 attacks, DHS developed the TSA Precheck system to enable travelers who provide information to demonstrate that they are low-risk to be screened via special lanes without removing their shoes and electronics. Could a similar system be developed for compliant H-2A employers?

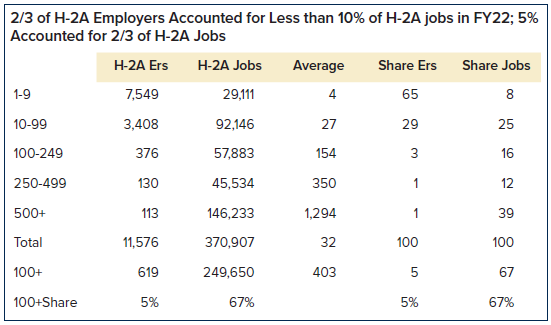

Direct-Hire and FLC

Some 12,200 unique employers were certified to fill almost 372,000 seasonal farm jobs with H-2A workers in FY22, an average 32 each. The five percent or 620 H-2A employers who were each certified for 100 or more H-2A workers accounted for two-thirds of all H-2A jobs certified, an average 400 each, and the 115 employers who were each certified to hire 500 or more H-2A workers accounted for 40 percent of all H-2A jobs certified, an average 1,300 each.

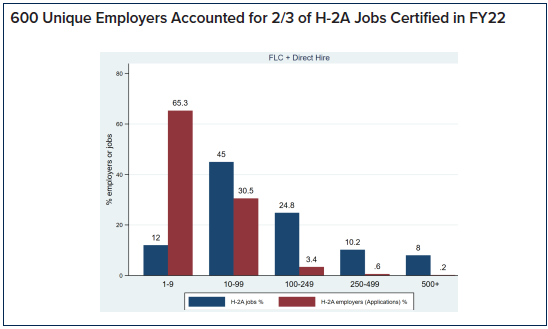

This means that about 100 US employers account for 40 percent of all H-2A jobs, and 600 employers account for 70 percent. DOL analysts spend most of their time processing applications from the 7,500 employers who are certified for less than 10 workers and collectively account for less than 10 percent of total H-2A certifications.

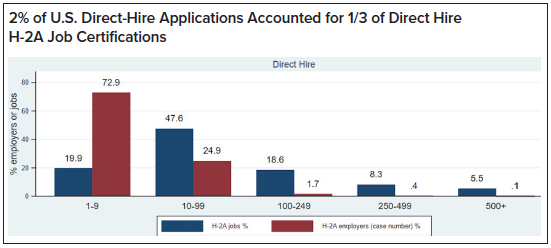

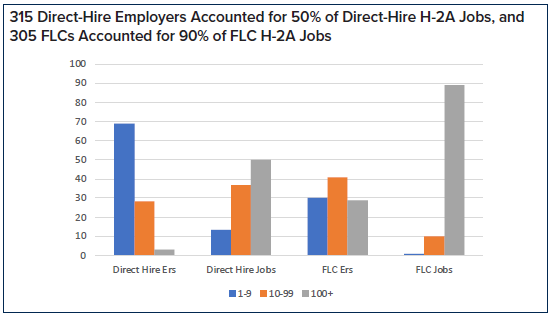

There are two major types of H-2A employers: direct hire and FLC. Direct-hire employers supervise the H-2A workers they employ on their farms, and 10,500 direct-hire employers were certified to fill 207,000 jobs in FY22. The 315 direct-hire employers who were each certified to fill 100 or more jobs with H-2A workers accounted for half of all direct-hire job certifications.

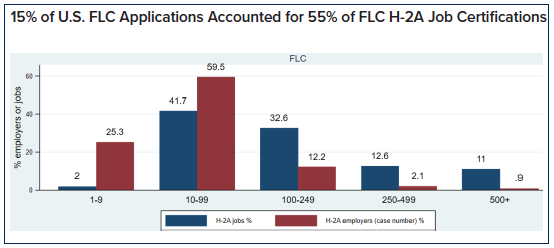

FLCs account for about 45 percent of H-2A job certifications, and the 15 percent of FLC employers who were each certified for 100 or more H-2A workers accounted for over 55 percent of all FLC H-2A job certifications, that is, FLC job certifications were much more concentrated than direct-hire certifications. At the other end of the FLC size spectrum, a quarter of FLCs were each certified for less than 10 H-2A workers and accounted for two percent of FLC H-2A job certifications.

FLC employers bring H-2A workers to client farms. Some 1,100 FLCs were certified to fill 164,000 jobs with H-2A workers in FY22. Over 70 percent of these FLCs provided fewer than 100 H-2A workers to client farms, but the 305 who each provided 100 or more H-2A workers accounted for 90 percent of all H-2A jobs that were certified to FLCs. There are about 3,000 US FLCs registered with state UI authorities, suggesting that a third employ H-2A workers.

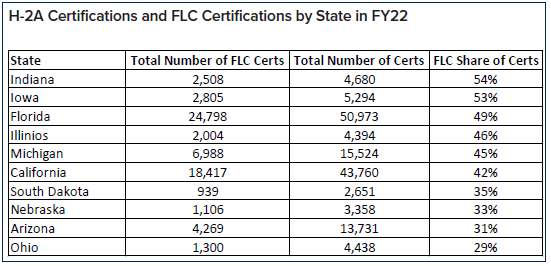

FLCs accounted for most H-2A employment in midwestern states such as Iowa and Indiana, but FLCs do not play a significant role in H-2A employment in the northeastern states. The FLC share of H-2A certifications in the states with the most H-2A job certifications was highest in FL and CA at 49 and 42 percent, respectively, and lowest in WA at seven percent. The FLC share was 22 percent in GA and 25 percent in NC.

If DOL developed a TSA-style precheck system for the 600 largest direct-hire and FLC employers with in-house HR and compliance units, half of direct-hire and 90 percent of FLC H-2A workers would have a second level of (private) protection via these in-house resources. The challenge for DOL is to enforce labor laws among the almost 11,000 smaller direct hire employers and 750 smaller FLCs.

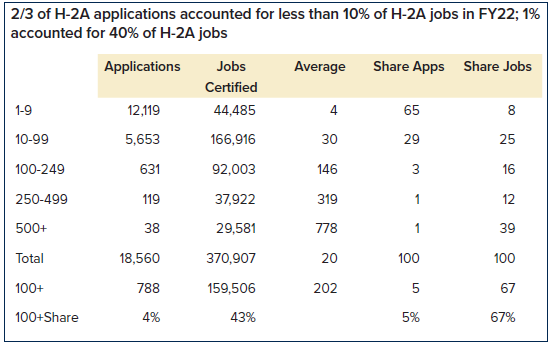

Many employers file multiple applications for H-2A workers, as when an association files on behalf of 50 or more direct-hire employers or FLCs file applications on behalf of multiple farm clients. Some 11,600 employers filed over 18,560 applications for H-2A certification in FY22.

The average number of jobs certified per application is 20, but this average conceals significant variance. Two thirds of H-2A applications request certification for fewer than 10 H-2A jobs, an average four each and collectively less than 10 percent of all H-2A jobs certified. At the other end of the size spectrum, almost 800 applications were for 100+ H-2A workers, an average 200 each and collectively almost 45 percent of all jobs certified in FY22. The one percent of applications certified for 500 or more H-2A jobs accounted for almost 40 percent of the total.

H-2A applications are less concentrated than H-2A employers because large H-2A employers often file multiple applications.

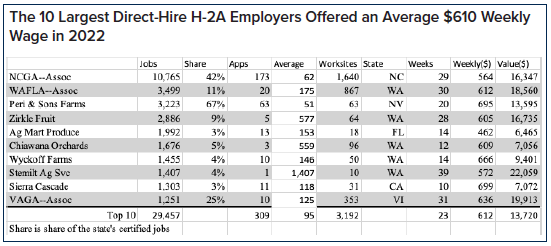

Who are the large direct-hire and FLC employers in the H-2A program? The top 10 direct-hire employers filed 310 applications and were certified to fill 29,500 jobs in FY22, an average 95 jobs per application and a seventh of the 207,000 jobs certified to direct-hire employers. Employers must specify the worksite where the H-2A workers will be employed, and the top 10 direct-hire employers specified almost 3,200 worksites.

Half of the 10 largest direct-hire H-2A employers were in Washington, including the association Wafla and four tree fruit growers. The largest direct-hire H-2A employer was the North Carolina Growers Association, which filed almost 175 applications to place over 10,750 H-2A workers in over 1,600 worksites and accounted for over 40 percent of NC’s H-2A jobs. Peri and Sons was the third-largest direct employer and accounted for two-thirds of Nevada’s H-2A jobs.

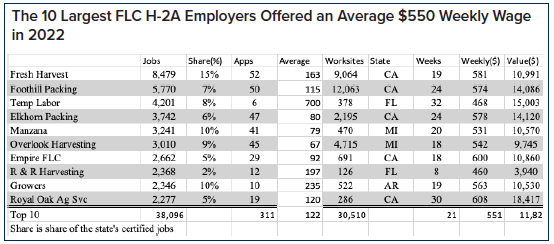

The top 10 FLC employers filed 311 applications and were certified to fill 30,500 jobs in FY22, an average 120 jobs per application and a quarter of the 164,000 jobs certified to FLCs. The top 10 FLCs specified over 30,000 worksites where H-2A workers would be employed, ten times more than the number of worksites specified by the top 10 direct-hire employers.

Half of the five largest FLC employers were in California, including the two largest, Fresh Harvest and Foothill Packing, and they collectively accounted for almost 40 percent of the state’s certified jobs. The two large FLCs in Florida included Temp Labor, whose applications requested an average 700 H-2A workers. The two Michigan FLCs among the top ten included Manzana and Overlook, FLCs that together accounted for over 80 percent of the H-2A jobs certified in Michigan.

There was significant variance in the average weeks of work offered in the contracts of the top 10 FLCs, from a low of eight weeks offered by R&R in Florida to a high of 32 weeks offered by Temp Labor in Florida. Weekly wages, the AEWR times the number of hours promised in contracts, averaged $550 and ranged from a low of $460 for R&R in Florida to a high of $600 or more for Empire and Royal Oak in California. Actual wages could be higher if workers were employed for piece rate wages and earned more than the AEWR or worked more hours than specified in the contract, or lower if the employer satisfied only the three-fourths guarantee, paying for three-fourths of the hours of work promised.

NAICS

DOL stopped reporting the commodity where H-2A workers are employed in 2020, so that commodity data are available only for employer job orders that add Addendum A. A third of employer applications and half of H-2A job certifications in FY22 included Addendum A.

Farm employers are classified in the NAICS by the commodities that accounted for the majority of farm’s sales. The largest number of H-2A job certifications are in NAICS 1151, support activities for crop production, and 60 percent of average crop support employment is with FLCs. There are no data on the commodities where crop support employees perform work.

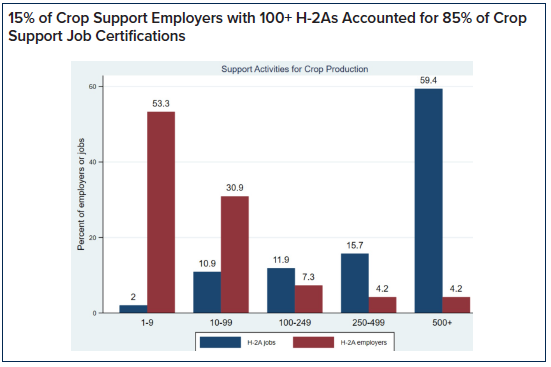

Crop support H-2A certifications are concentrated. The 15 percent of crop support employers who were certified for 100+ H-2A workers collectively accounted for over 85 percent of all crop support certifications. At the other end of the size spectrum, the 85 percent of crop support employers who were certified for fewer than 100 H-2A workers collectively accounted for an eighth of crop support certifications.

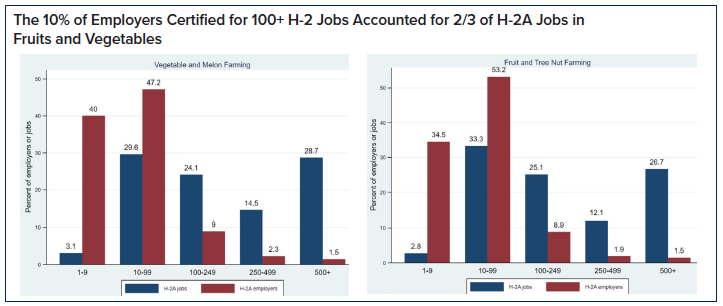

The distribution of H-2A employers and H-2A jobs is similar in NAICS 1112 vegetables and 1113 fruits, that is, the 10 percent of employers who were certified for 100 or more H-2A workers accounted for two-thirds of H-2A job certifications in fruits and vegetables in FY22.

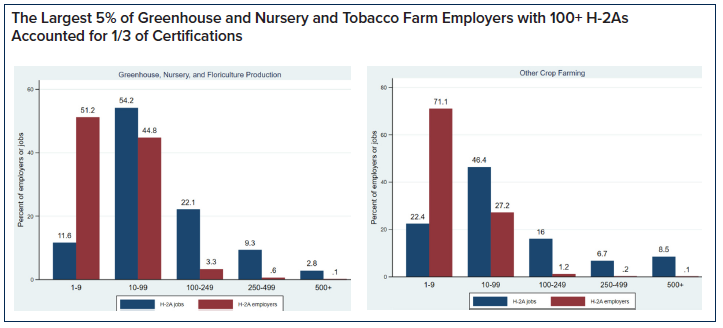

Employers and jobs differ in other commodities. For example, less than five percent of greenhouse and nursery and other crop (tobacco and sugar) employers had 100+ job certifications, and collectively they accounted for a third of H-2A certifications in these commodities.

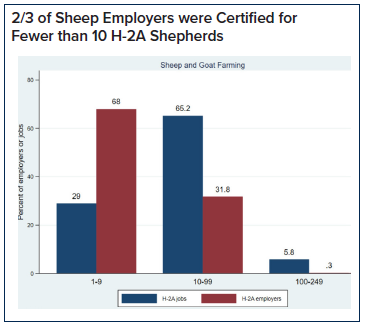

Most animal agriculture operations cannot employ H-2A workers because animal jobs are usually year-round rather than seasonal. Sheepherding is an exception. The US has about five million sheep and, especially in the western states, sheep farmers often employ one H-2A shepherd for each 1,000 to 2,000 sheep, so that up to 5,000 shepherds are required for the US flock. Most sheep farms have less than 10 H-2A shepherds, and over 99 percent of sheep employers were certified for fewer than 100 H-2A shepherds.

Agents

Many farmers and FLCs rely on intermediaries to apply for H-2 workers. These agents encompass law firms and other service businesses that take on a range of roles, from simply advising employers how to write job titles and describe the work to be performed to recruiting workers abroad, arranging for them to obtain visas, and transporting them to the US worksite.

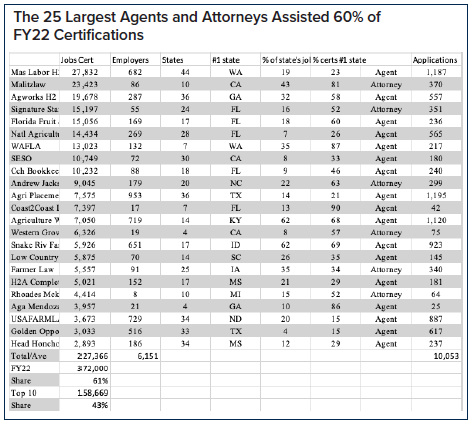

The 25 largest agents and attorneys accounted for 60 percent of H-2A job certifications. The largest was Mas Labor, whose 28,000 H-2A certifications were almost eight percent of the 372,000 total in FY22, and Malitz Law, whose 23,400 were six percent. The top 10 agents and attorneys assisted in 43 percent of FY22 job certifications.

Agents are the major point of contact with SWAs and OFLC when the government considers whether to certify an employer’s request for H-2A workers, but the employer rather than the agent is responsible for complying with labor laws and H-2A regulations. There appears to be no association of H-2A agents, some of whom have been sued in egregious cases. For example, workers in one case were recruited by an agent in Mexico to do farm work for one employer, but wound up doing nonfarm work for another, with the agent assisting in the unlawful transfer of H-2A workers from the certified to the non-certified employer.

Author

Mexico Institute

The Mexico Institute seeks to improve understanding, communication, and cooperation between Mexico and the United States by promoting original research, encouraging public discussion, and proposing policy options for enhancing the bilateral relationship. A binational Advisory Board, chaired by Luis Téllez and Earl Anthony Wayne, oversees the work of the Mexico Institute. Read more

Explore More

Browse Insights & Analysis

Water Security at the US-Mexico Border | Part 1: Background

China and the Chocolate Factory

Ongoing Debate: The Prohibition of GMO Corn in Mexico